Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Chart Pattern Matching for [C] Citigroup Inc.

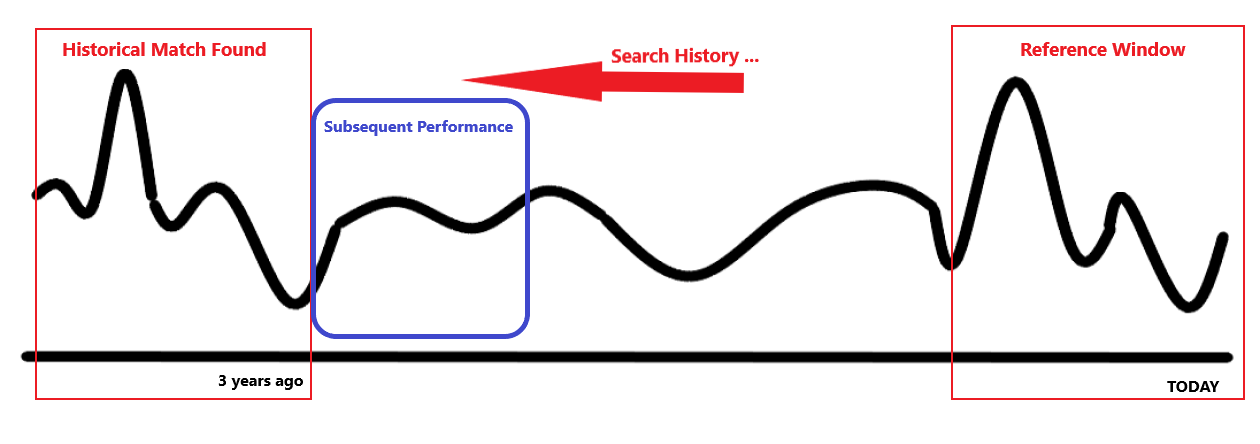

Data updated 2025-Jul-16 (Wednesday)Chart Pattern Matching analyzes performance history for Citigroup Inc. to find similar patterns using a 5-day sliding window for Daily Performance compared to the prevailing pattern up to last market close on 2025-Jul-16. Pattern Matching is an AI variation of traditional Technical Chart analysis (where humans interpret Chart patterns looking for certain shapes). Subsequent performances summarized below for top matches

Provided As-is for informational/educational purposes only and should not be construed as investment advice . Past performance may not be not indicative of future results. Always consult your Investment Adviser before any decision

Share

Use widget to view Pattern Matching for other Stocks/ETFs/Indices

Select Metric above to Pattern Match against

Select Timeframe above to Pattern Match against

Outlook

Pattern Matching 5-day Daily Performance results for Citigroup Inc. are calculated as of 2025-Jul-16 (5 months ago):

Next 5-day performance is estimated to be +1.5% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 10-day performance is estimated to be +1.3% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 20-day performance is estimated to be +1.7% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 50-day performance is estimated to be +4.0% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 100-day performance is estimated to be -9.2% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 200-day performance is estimated to be -24.9% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 5-day performance is estimated to be +1.5% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 10-day performance is estimated to be +1.3% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 20-day performance is estimated to be +1.7% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 50-day performance is estimated to be +4.0% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bullish

Next 100-day performance is estimated to be -9.2% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 200-day performance is estimated to be -24.9% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Summary 2025-Jul-16 Wednesday

| Next 5d | Next 10d | Next 20d | Next 50d | Next 100d | Next 200d | |

|---|---|---|---|---|---|---|

|

Frequency

|

|

|

|

|

|

|

|

Mean

|

+1.5%

|

+1.3%

|

+1.7%

|

+4.0%

|

-0.2%

|

-12.2%

|

|

Median

|

+0.8%

|

-0.1%

|

+3.1%

|

+1.8%

|

-5.3%

|

-27.2%

|

|

Minimum

|

-5.8%

|

-7.6%

|

-10.5%

|

-9.9%

|

-21.1%

|

-32.5%

|

|

Maximum

|

+12.5%

|

+12.8%

|

+17.8%

|

+34.5%

|

+55.2%

|

+50.2%

|

While traditional Chart Analysis looks for specific shapes (e.g. Double Top / Bottom, Cup & Handle, Head & Shoulders, Wedge etc.) and interprets them as being bullish/bearish, Pattern Matching instead looks at the current pattern (whatever that may be) and goes back in time to find similars. Calculation is based on Procrustes Analysis techniques using absolute values as well as overall shape of pattern. Absolute values are not used for Unbounded metrics (like Price), which are normalized

Closest pattern matches for 2025-Jul-16 below. Longer time-frames inherently have lower match scores. Click on date to view historical record or inspect charts side-by-side on historic date vs last close using the compare functionality

| Date | Match Score | Actions | Next 5d | Next 10d | Next 20d | Next 50d | Next 100d | Next 200d |

|---|---|---|---|---|---|---|---|---|

|

91.5

|

|

+5.0%

|

+9.3%

|

+9.0%

|

-5.7%

|

|

|

|

|

90.6

|

|

+3.3%

|

-0.1%

|

+2.4%

|

+7.7%

|

-4.7%

|

-16.4%

|

|

|

90.5

|

|

-1.6%

|

-2.0%

|

-2.0%

|

+34.5%

|

+55.2%

|

+50.2%

|

|

|

90.4

|

|

-1.3%

|

-4.9%

|

|

|

|

|

|

|

90.2

|

|

+4.8%

|

|

|

|

|

|

|

|

87.6

|

|

+2.9%

|

|

|

|

|

|

|

|

87.1

|

|

-1.6%

|

-2.9%

|

-5.3%

|

-1.0%

|

-5.3%

|

-29.4%

|

|

|

87.0

|

|

+12.5%

|

+12.8%

|

+17.8%

|

+15.2%

|

+43.7%

|

+40.3%

|

|

|

86.7

|

|

-2.9%

|

|

|

|

|

|

|

|

85.2

|

|

+0.8%

|

-0.9%

|

-1.0%

|

+0.3%

|

-15.5%

|

-26.3%

|

|

|

84.6

|

|

-0.3%

|

+6.9%

|

+3.7%

|

+7.0%

|

-2.4%

|

|

|

|

84.1

|

|

-5.8%

|

-2.3%

|

-6.2%

|

-3.7%

|

-14.2%

|

-27.7%

|

|

|

84.0

|

|

+8.4%

|

+3.8%

|

+4.1%

|

+3.3%

|

-11.5%

|

-27.3%

|

|

|

84.0

|

|

+0.8%

|

-4.5%

|

-9.1%

|

-7.3%

|

-8.8%

|

-30.0%

|

|

|

83.9

|

|

-5.2%

|

-7.6%

|

-10.5%

|

-1.4%

|

-21.1%

|

-27.2%

|

|

|

83.8

|

|

+5.5%

|

+1.0%

|

+4.2%

|

-9.9%

|

-15.7%

|

-32.5%

|

|

|

83.5

|

|

-1.2%

|

|

|

|

|

|

|

|

83.4

|

|

-0.6%

|

|

|

|

|

|

|

|

83.3

|

|

+3.3%

|

+3.0%

|

+10.1%

|

+5.3%

|

-0.7%

|

|

|

|

83.2

|

|

+3.6%

|

+8.8%

|

+6.4%

|

+11.4%

|

-1.7%

|

-7.8%

|

Related to Citigroup Inc.

Information for Citigroup Inc.

Current Detail : Recent daily/monthly performance & benchmark comparison

Historical Detail : Historical performance & related information using Time Machine

Financial Statements : Analyze Income Statement, Balance Sheet & Cashflow Statement and also compare with peers

Bayesian Statement Classifier : Investigate historical financial statements to make probabalistic predictions using Artificial Intelligence

Anomaly Detection : Investigate unusual recent performance & technicals with historical context using AI

Historical Seasonality : Seasonal performance by calendar months

Dividend History : History of Dividend Yield

Technical History : Popular Technical indicator trends (RSI, MACD etc.)

Metric Deciles : Contextualizing recent performance & technical levels into historical decile buckets

Dollar Cost Averaging : Dollar Cost Average (DCA) over time in your portfolio

Moving Averages : Key Simple & Exponential Moving Averages

Historical Analogues : Insights from closest historical matches to recent performance using Artificial Intelligence

Chart Pattern Matching : Insights from similar historical charts to recent chart using Artificial Intelligence Currently Viewing

News Stories : News stories on 2025-Oct-24 on Google

SEC Reports : Quarterly reports around 2025-Oct-24 on SEC Edgar

Compare Citigroup Inc. with other assets

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Pair Correlations : Performance Correlations with other assets

Beta : Volatility relative to the broad market

Performance Comparison : Visually compare/benchmark performance with other assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Financials sector performance which includes Citigroup Inc.

Industry : Banking industry performance which includes Citigroup Inc.