Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Historical Analogues for [EA] Electronic Arts Inc.

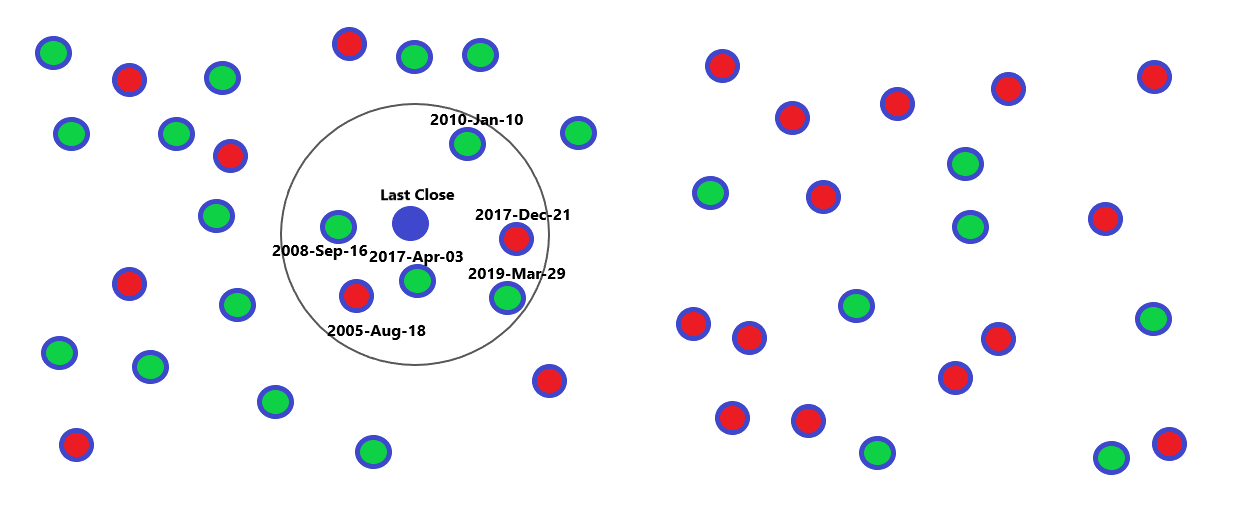

Data updated 2025-Jul-16 (Wednesday)Historical Analogues searches history for Electronic Arts Inc. to find similar situations as compared to last market close on 2025-Jul-16 and presents subsequent performances for those cases. This adaptation of popular Machine Learning technique kNN provides historical context to recent performance

Provided As-is for informational/educational purposes only and should not be construed as investment advice . Past performance may not be not indicative of future results. Always consult your Investment Adviser before any decision

Share

Use widget to view Historical Analogues for other Stocks/ETFs/Indices

Outlook

Historical Analogues for Electronic Arts Inc. are calculated as of 2025-Jul-16 (4 months ago):

Next 5-day performance is estimated to be +2.4% using the more frequently occurring up subsequent performances of close matches. Outlook is bullish

Next 10-day performance is estimated to be +1.6% using the more frequently occurring up subsequent performances of close matches. Outlook is bullish

Next 20-day performance is estimated to be -1.9% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 50-day performance is estimated to be -2.3% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bearish

Next 100-day performance is estimated to be -11.2% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 200-day performance is estimated to be -11.6% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 5-day performance is estimated to be +2.4% using the more frequently occurring up subsequent performances of close matches. Outlook is bullish

Next 10-day performance is estimated to be +1.6% using the more frequently occurring up subsequent performances of close matches. Outlook is bullish

Next 20-day performance is estimated to be -1.9% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 50-day performance is estimated to be -2.3% using the mean of all subsequent performances (as frequency distribution is near even) of close matches. Outlook is bearish

Next 100-day performance is estimated to be -11.2% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Next 200-day performance is estimated to be -11.6% using the more frequently occurring down subsequent performances of close matches. Outlook is bearish

Summary 2025-Jul-16 Wednesday

| Next 5d | Next 10d | Next 20d | Next 50d | Next 100d | Next 200d | |

|---|---|---|---|---|---|---|

|

Frequency

|

|

|

|

|

|

|

|

Mean

|

+1.2%

|

+0.8%

|

+0.1%

|

-2.3%

|

-7.3%

|

-11.6%

|

|

Median

|

+1.3%

|

+0.9%

|

-0.3%

|

-2.6%

|

-11.1%

|

-11.7%

|

|

Minimum

|

-3.4%

|

-1.6%

|

-3.7%

|

-10.6%

|

-15.0%

|

-15.0%

|

|

Maximum

|

+4.6%

|

+2.8%

|

+4.8%

|

+5.7%

|

+2.5%

|

-7.1%

|

Similarity is calculated using normalized euclidean distances and factors curated attributes like the days performance, volatility, prior performance over multiple periods and key technical indicators like RSI, MACD etc.

Historical Analogues is primarily a point-in-time view of the state of the Stock/Index/ETF with lookback anchors past performance rather than comparing the exact path taken to get there. Model does NOT consider historical matches on absolute values of Open/High/Low/Close values. There is inherent subjectivity as there are many different ways to calculate similarity, select features for the model etc. Results are provided for informational purposes only.

Historical Analogues is primarily a point-in-time view of the state of the Stock/Index/ETF with lookback anchors past performance rather than comparing the exact path taken to get there. Model does NOT consider historical matches on absolute values of Open/High/Low/Close values. There is inherent subjectivity as there are many different ways to calculate similarity, select features for the model etc. Results are provided for informational purposes only.

Closest historical matches for 2025-Jul-16 below. Click on date to view historical record or inspect stats side-by-side on historic date vs last close using the compare functionality

| Date | Match Score | Actions | Next 5d | Next 10d | Next 20d | Next 50d | Next 100d | Next 200d |

|---|---|---|---|---|---|---|---|---|

|

94.5

|

|

+2.8%

|

|

|

|

|

|

|

|

92.4

|

|

-0.3%

|

|

|

|

|

|

|

|

92.4

|

|

+1.5%

|

+2.8%

|

-3.3%

|

-7.7%

|

-11.9%

|

-9.1%

|

|

|

92.3

|

|

-1.2%

|

+0.1%

|

+4.7%

|

-3.0%

|

-4.9%

|

-7.1%

|

|

|

92.2

|

|

+0.6%

|

-0.9%

|

0.0%

|

-2.2%

|

-11.4%

|

-12.3%

|

|

|

91.8

|

|

+2.3%

|

+1.5%

|

-0.1%

|

+4.0%

|

+2.5%

|

-11.4%

|

|

|

91.5

|

|

+4.0%

|

|

|

|

|

|

|

|

91.1

|

|

+3.6%

|

|

|

|

|

|

|

|

90.7

|

|

-0.1%

|

+2.7%

|

-3.7%

|

-10.3%

|

-15.0%

|

-11.9%

|

|

|

90.7

|

|

+2.0%

|

-0.6%

|

-0.5%

|

+1.1%

|

-10.7%

|

-15.0%

|

|

|

90.5

|

|

+2.5%

|

+1.7%

|

+4.6%

|

+5.7%

|

+1.9%

|

-10.9%

|

|

|

90.2

|

|

+4.6%

|

|

|

|

|

|

|

|

89.9

|

|

-3.4%

|

|

|

|

|

|

|

|

89.8

|

|

+1.1%

|

|

|

|

|

|

|

|

89.8

|

|

+0.1%

|

-1.6%

|

-2.1%

|

-4.9%

|

-11.9%

|

-13.4%

|

|

|

89.6

|

|

-0.7%

|

|

|

|

|

|

|

|

89.3

|

|

+3.5%

|

+2.0%

|

+4.8%

|

+4.8%

|

+0.7%

|

-11.6%

|

|

|

89.1

|

|

-1.7%

|

+0.3%

|

-3.4%

|

-10.6%

|

-12.5%

|

-13.8%

|

Related to Electronic Arts Inc.

Information for Electronic Arts Inc.

Current Detail : Recent daily/monthly performance & benchmark comparison

Historical Detail : Historical performance & related information using Time Machine

Financial Statements : Analyze Income Statement, Balance Sheet & Cashflow Statement and also compare with peers

Bayesian Statement Classifier : Investigate historical financial statements to make probabalistic predictions using Artificial Intelligence

Anomaly Detection : Investigate unusual recent performance & technicals with historical context using AI

Historical Seasonality : Seasonal performance by calendar months

Dividend History : History of Dividend Yield

Technical History : Popular Technical indicator trends (RSI, MACD etc.)

Metric Deciles : Contextualizing recent performance & technical levels into historical decile buckets

Dollar Cost Averaging : Dollar Cost Average (DCA) over time in your portfolio

Moving Averages : Key Simple & Exponential Moving Averages

Historical Analogues : Insights from closest historical matches to recent performance using Artificial Intelligence Currently Viewing

Chart Pattern Matching : Insights from similar historical charts to recent chart using Artificial Intelligence

News Stories : News stories on 2025-Oct-24 on Google

SEC Reports : Quarterly reports around 2025-Oct-24 on SEC Edgar

Compare Electronic Arts Inc. with other assets

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Pair Correlations : Performance Correlations with other assets

Beta : Volatility relative to the broad market

Performance Comparison : Visually compare/benchmark performance with other assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Communication Services sector performance which includes Electronic Arts Inc.

Industry : Gaming industry performance which includes Electronic Arts Inc.