Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Daily S&P 500 Lows

Data updated 2024-Nov-20 (Wednesday)Quick Instructional video for this page. Collapse this after viewing by clicking How-to button above. Open in new tab

Share

Choose condition for frequency distribution

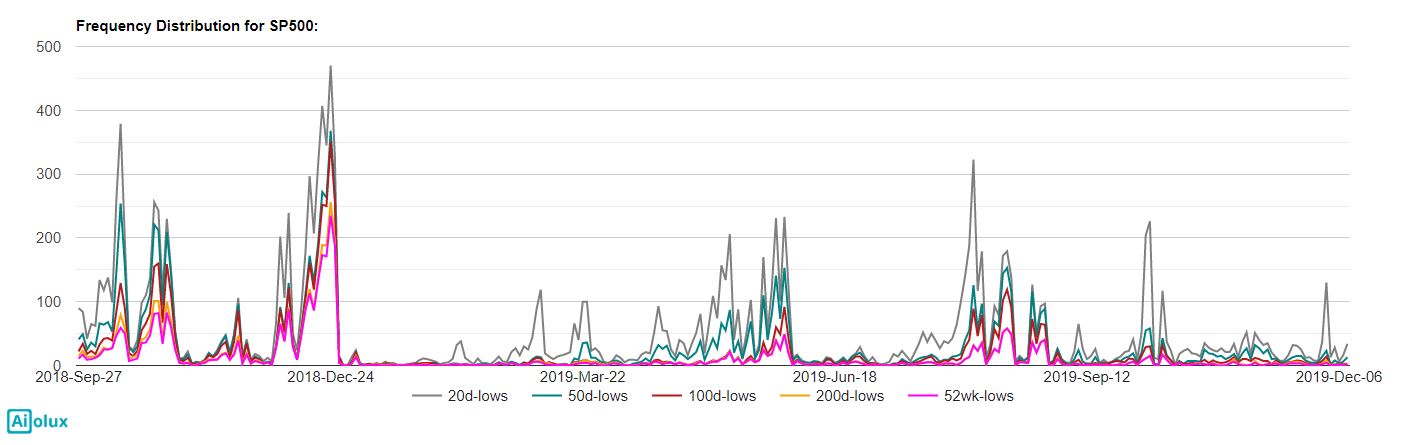

Frequency Distribution of S&P 500 constituents at various period lows updated up to Nov-20 (Wednesday). Use blue widget below to further filter by Sector

Use widget to select sectors

Calculation Methodology: Daily lows are compared with lows of key prior periods [20-days, 50-days, 100-days, 200-days, 52-weeks]

Only Current S&P500 constituents are considered (even for historical dates)

Only Current S&P500 constituents are considered (even for historical dates)

How to use this:

Elevated numbers of stocks hitting higher period highs/lows (e.g. 200-day, 52-week) lines may signal major tops/bottoms in the medium-term for the broader market or a particular sector

Similarly elevated levels for shorter period highs/lows indicate overbought/oversold conditions in the shorter term

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Highs/Lows Distribution calculated using current S&P 500 constituents shows number of stocks at key period lows. Table displays S&P 500 stocks hitting key period lows on 2024-Nov-20

| Symbol | Name | Sector | Max Lows Period |

|---|---|---|---|

| LRCX |

Lam Research Corp.

|

Information Technology | 52wk |

| DG |

Dollar General Corp.

|

Consumer Discretionary | 52wk |

| REGN |

Regeneron Pharmaceuticals, Inc.

|

Health Care | 52wk |

| LYB |

LyondellBasell Industries NV

|

Materials | 52wk |

| ULTA |

Ulta Beauty Inc

|

Consumer Discretionary | 50d |

| MPWR |

Monolithic Power System Inc

|

Information Technology | 200d |

| CDW |

CDW Corp

|

Information Technology | 52wk |

| QRVO |

Qorvo, Inc.

|

Information Technology | 52wk |

| HCA |

HCA Healthcare Inc

|

Health Care | 50d |

| AVGO |

Broadcom Inc.

|

Information Technology | 20d |

| SEDG |

Solaredge Technologies Inc

|

Information Technology | 52wk |

| COO |

Cooper Companies, Inc.

|

Health Care | 50d |

| TER |

Teradyne Inc

|

Information Technology | 100d |

| TECH |

Bio-Techne Corp

|

Health Care | 100d |

| VRTX |

Vertex Pharmaceuticals Inc.

|

Health Care | 100d |

| ROST |

Ross Stores, Inc.

|

Consumer Discretionary | 50d |

| MTCH |

Match Group Inc

|

Communication Services | 50d |

| AOS |

A. O. Smith Corp.

|

Industrials | 52wk |

| TGT |

Target Corp.

|

Consumer Discretionary | 52wk |

| A |

Agilent Technologies, Inc.

|

Health Care | 50d |

| MDT |

Medtronic plc

|

Health Care | 50d |

| LHX |

L3Harris Technologies Inc

|

Industrials | 20d |

| BBY |

Best Buy Co., Inc.

|

Consumer Discretionary | 50d |

| ARE |

Alexandria Real Estate Equities,...

|

Real Estate | 52wk |

| GD |

General Dynamics Corp.

|

Industrials | 50d |

| WY |

Weyerhaeuser Co.

|

Real Estate | 50d |

| NKE |

NIKE, Inc. Cl. B

|

Consumer Discretionary | 50d |

| TXN |

Texas Instruments Inc.

|

Information Technology | 20d |

| STE |

STERIS Corp

|

Health Care | 100d |

| CE |

Celanese Corp

|

Materials | 52wk |

| NOC |

Northrop Grumman Corp.

|

Industrials | 50d |

| HAS |

Hasbro, Inc.

|

Consumer Discretionary | 50d |

| PPG |

PPG Industries, Inc.

|

Materials | 50d |

| ECL |

Ecolab Inc.

|

Materials | 50d |

| BF.B |

Brown-Forman Corp. Cl. B

|

Consumer Staples | 52wk |

| MTD |

Mettler-Toledo International Inc.

|

Health Care | 100d |

| WBA |

Walgreens Boots Alliance Inc

|

Consumer Staples | 52wk |

| BIIB |

Biogen Inc.

|

Health Care | 52wk |

| AES |

AES Corp.

|

Utilities | 52wk |

| TEL |

TE Connectivity Ltd.

|

Information Technology | 20d |

| TFX |

Teleflex Inc

|

Health Care | 52wk |

| JKHY |

Jack Henry Associates Inc

|

Information Technology | 50d |

| DOW |

Dow Inc

|

Materials | 52wk |

| QCOM |

QUALCOMM Inc.

|

Information Technology | 50d |

| MOS |

Mosaic Co.

|

Materials | 20d |

| UHS |

Universal Health Services, Inc. ...

|

Health Care | 50d |

Related Links

Dashboard : Market Pulse using broad themes (e.g. Growth vs. Value, Equities vs. Treasuries etc.)

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

World Explorer : Performance & Correlation between key countries across the world

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

World Explorer : Performance & Correlation between key countries across the world

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels