Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Daily S&P 500 Highs [Consumer Discretionary]

Data updated 2024-Nov-22 (Friday)Quick Instructional video for this page. Collapse this after viewing by clicking How-to button above. Open in new tab

Share

Choose condition for frequency distribution

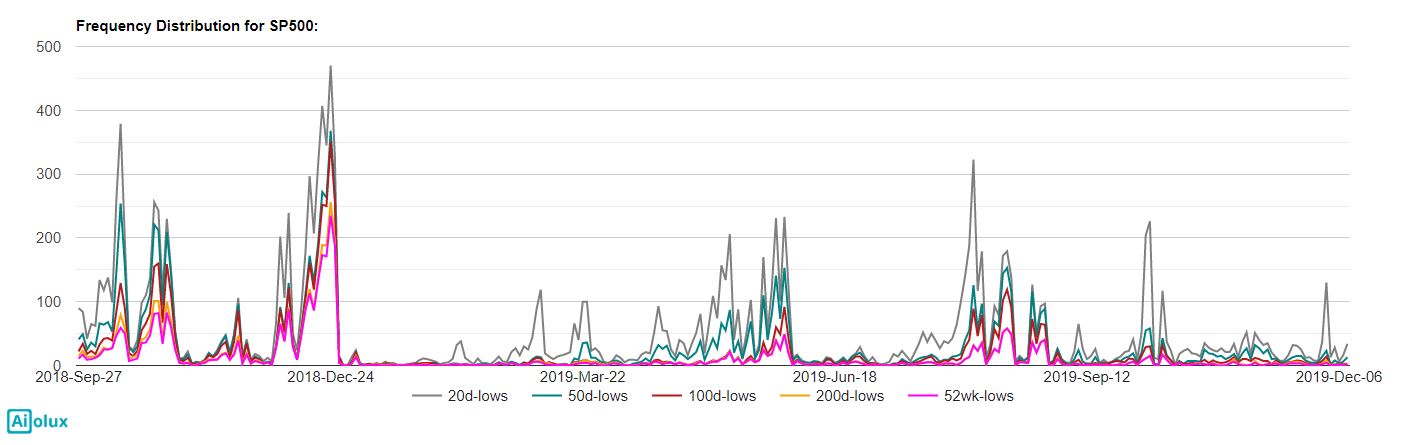

Frequency Distribution of S&P 500 constituents at various period highs updated up to Nov-22 (Friday). Use blue widget below to further filter by Sector

Use widget to select sectors

Calculation Methodology: Daily highs are compared with highs of key prior periods [20-days, 50-days, 100-days, 200-days, 52-weeks]

Only Current S&P500 constituents are considered (even for historical dates)

Only Current S&P500 constituents are considered (even for historical dates)

How to use this:

Elevated numbers of stocks hitting higher period highs/lows (e.g. 200-day, 52-week) lines may signal major tops/bottoms in the medium-term for the broader market or a particular sector

Similarly elevated levels for shorter period highs/lows indicate overbought/oversold conditions in the shorter term

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Interpretation above is not comprehensive but rather just a starting point of understanding. Experienced market professionals typically use a combination of different datapoints to drive decisions

Highs/Lows Distribution calculated using current S&P 500 constituents shows number of stocks at key period highs. Table displays S&P 500 stocks filtered for Consumer Discretionary sector hitting key period highs on 2024-Nov-22

| Symbol | Name | Sector | Max Highs Period |

|---|---|---|---|

| RCL |

Royal Caribbean Cruises Ltd.

|

Consumer Discretionary | 52wk |

| TSLA |

Tesla Inc

|

Consumer Discretionary | 52wk |

| CMG |

Chipotle Mexican Grill, Inc.

|

Consumer Discretionary | 50d |

| KMX |

CarMax, Inc.

|

Consumer Discretionary | 50d |

| SBUX |

Starbucks Corp.

|

Consumer Discretionary | 200d |

| ROST |

Ross Stores, Inc.

|

Consumer Discretionary | 20d |

| TPR |

Tapestry, Inc.

|

Consumer Discretionary | 52wk |

| HD |

Home Depot, Inc.

|

Consumer Discretionary | 20d |

| BKNG |

Booking Hldgs. Inc.

|

Consumer Discretionary | 52wk |

Related Links for Consumer Discretionary

Dashboard : Market Pulse using broad themes (e.g. Growth vs. Value, Equities vs. Treasuries etc.)

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels

Snapshots : Popular lists of stocks & etfs (best streaks, most beaten down etc. in last X days)

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Performance Comparison : Chart compare/benchmark performance with multiple assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Analyze & compare Sector performance

Industry : Analyze & compare Industries within Sectors

Breakouts & Breakdowns : Identifying stocks/etfs which recently traded up/down in unusually elevated volumes

Swing Volatility : Identifying stocks/etfs with elevated volatility

Advance/Decline : Sentiment using accumulated advances & declines in S&P 500 stocks

Highs/Lows : Sentiment using frequency of key highs/lows in S&P 500 stocks Currently Viewing

Moving Average : Sentiment using frequency of S&P 500 stocks above key moving averages

Technical Distribution : Sentiment using frequency distribution of S&P 500 stocks with bullish/bearish technical levels