Check out Investor Copilot custom GPT, which lets you enjoy ChatGPT functionality with recent financial information

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

Conversationally interact with ChatGPT to now analyze updated prices, technical indicators, financial statements, macro-economic/company news & more for Stocks, ETFs & Cryptos

[ANSS] ANSYS, Inc. - Time Machine

Data updated 2021-May-21 (Friday)Quick Instructional video for this page. Collapse this after viewing by clicking How-to button above. Open in new tab

Share

Historical Summary: 2021-May-21 Friday

| Open | $336.30 | High | $336.99 +0.21% |

|---|---|---|---|

| Close | $330.26 | Low | $328.47 -2.33% |

| Volume | 271 Thousand 0.76x | Volatility | 2.59% |

| Change |

$-3.46

-1.04%

|

Streak | ↓ 1 days -1.04% |

| 20d SMA | $341.88 -3.4% | 50d SMA | $346.21 -4.6% | 100d SMA | $354.35 -6.8% | 200d SMA | $341.22 -3.2% |

| RSI | 43 | MACD | -0.7 | ADX | 32.4 | Stochastic Oscillator | 31.7 23.5 |

| CCI | -36.0 | ATR | 10.03 | OBV | 187 Million | Chaikin A/D | 198 Million |

Choose view type

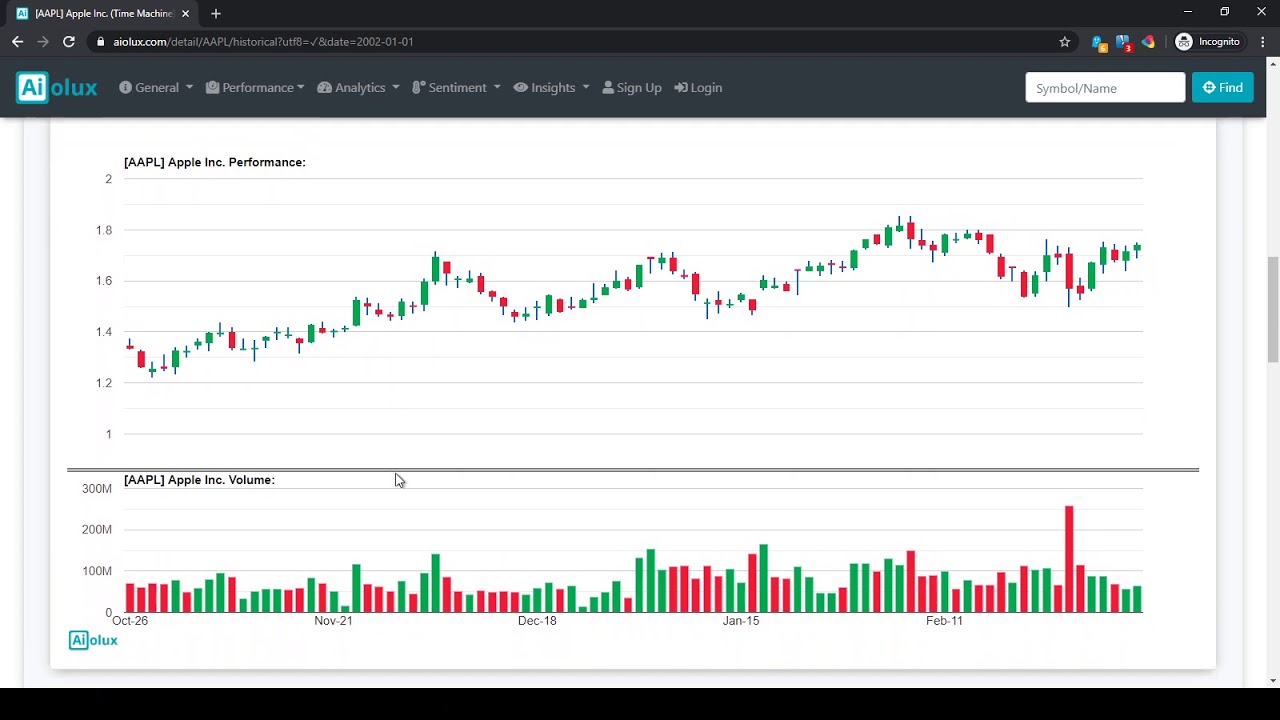

Daily Performance for ANSYS, Inc.. Click on candlesticks in Chart to show/hide summary for day or navigate to historical record (Time Machine functionality)

Max Chart Timespan

Max Chart Timespan

Note: Performance over Key Timeperiods for ANSYS, Inc. up to close of 2021-May-21 at $330.26

Performance Benchmarks from 2021-May-21 for ANSYS, Inc.:

Related to ANSYS, Inc.

Information for ANSYS, Inc.

Current Detail : Recent daily/monthly performance & benchmark comparison

Historical Detail : Historical performance & related information using Time Machine Currently Viewing

Financial Statements : Analyze Income Statement, Balance Sheet & Cashflow Statement and also compare with peers

Bayesian Statement Classifier : Investigate historical financial statements to make probabalistic predictions using Artificial Intelligence

Anomaly Detection : Investigate unusual recent performance & technicals with historical context using AI

Historical Seasonality : Seasonal performance by calendar months

Technical History : Popular Technical indicator trends (RSI, MACD etc.)

Metric Deciles : Contextualizing recent performance & technical levels into historical decile buckets

Dollar Cost Averaging : Dollar Cost Average (DCA) over time in your portfolio

Moving Averages : Key Simple & Exponential Moving Averages

Historical Analogues : Insights from closest historical matches to recent performance using Artificial Intelligence

Chart Pattern Matching : Insights from similar historical charts to recent chart using Artificial Intelligence

News Stories : News stories on 2021-May-21 on Google

SEC Reports : Quarterly reports around 2021-May-21 on SEC Edgar

Compare ANSYS, Inc. with other assets

Market Performance : Recent performance across covered assets

Historical Performance : Prior & Subsequent performance across assets on a historical date

Market Technicals : Technical indicator levels across covered assets

Market Seasonality : Seasonal performance by calendar months across covered assets

Pair Correlations : Performance Correlations with other assets

Beta : Volatility relative to the broad market

Performance Comparison : Visually compare/benchmark performance with other assets over time

Side-by-Side Comparison : Contrast with other assets over time in a side-by-side presentation

Sector : Information Technology sector performance which includes ANSYS, Inc.

Industry : Applications & Productivity industry performance which includes ANSYS, Inc.